News Corp records 7% revenue dip in Q2 2023; Binge subscribers approach 1.5m

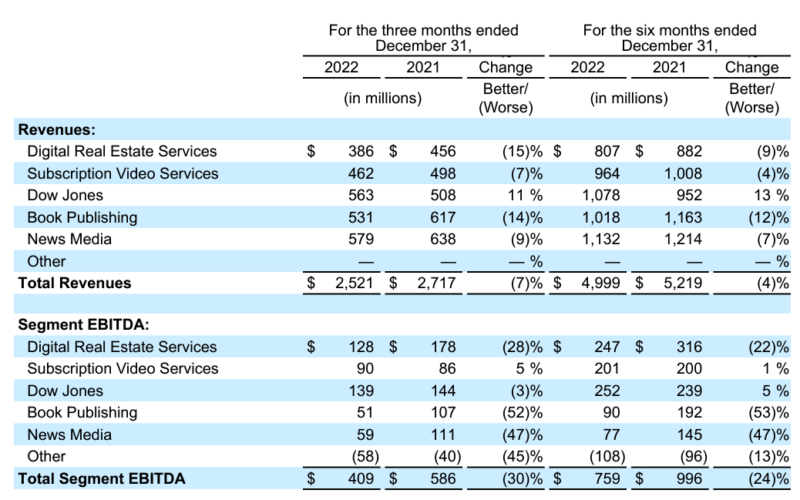

News Corporation has reported its second-quarter results for the 2023 financial year. The revenue dipped to US$2.52 billion (A$3.63 billion), a 7% decrease compared to the prior year period.

Net income for the three months ending December 2022 was $94 million (A$135 million), a decline compared to $262 million ($377 million) in the prior year.

This was due to lower Total Segment EBITDA, and higher losses from equity affiliates due to losses from News Corp’s investment in Australian wagering startup, Betr, partially offset by lower tax expenses.

The company attributed the overall revenue decline to the negative impact of foreign currency fluctuations, lower revenues in book publishing, and lower revenues in its digital real estate services due to the challenging Australian and US housing markets.

However, a boost in subscription video services (Foxtel) and Dow Jones revenues offset some of the declines.

The quarterly revenue of all segments saw a decline except for Dow Jones, which posted an 11% year-on-year (YoY) increase.

Total Segment EBITDA was down 30% for the quarter to US$409 million (A$589 million). However, it was the segment of subscription video services that saw the only increase of 5% to US$90 million (A$129 million).

Jointly owned Foxtel has more than 4.3 million paid subscribers as of 31 December 2022, a 10% increase YoY. The growth was driven by Binge and Kayo subscribers but was partially offset by lower residential broadcast subscribers.

For the News Media segment, the total advertising revenue decreased by US$37 million (A$53 million), or 13% YoY. News Corp Australia’s relevant operations saw a 13% decrease in total revenue. Closing digital subscribers at News Corp Australia as of 31 December 2022 were just over one million (924,000 for news mastheads), compared to 909,000 (861,000 for news mastheads) in the prior year.

In Digital Real Estate Services, REA Group posted a US$47 million (A$67 million), or 16% decline in revenue, partially due to lower Australian residential revenues due to the decline in national listings, most notably in Sydney and Melbourne.

Australian national residential buy listing volumes in the quarter declined 21% compared to the prior year, with listings in Sydney and Melbourne down 34% and 31%, respectively.

Book Publishing continued a downward trend, posting an US$86 million (A$124 million) or 14% decrease due to slowing consumer demand, difficult frontlist comparisons and some logistical constraints at Amazon. News Corp owns HarperCollins and a list of its imprints.

For the six months ending 31 December 2022, net cash provided by operating activities was US$161 million (A$232 million), $269 million (A$387 million) lower than the US$430 million (A$620 million) in the prior year. Free cash flow in the same period was negative US$56 million (A$80 million) compared to US$222 million (A$320 million) in the prior year.

However, the company stressed in the report: “The company believes free cash flow available to News Corporation provides a more conservative view of the company’s free cash flow because this presentation includes only that amount of cash the company actually receives from REA Group, which has generally been lower than the company’s unadjusted free cash flow.

“A limitation of both free cash flow and free cash flow available to News Corporation is that they do not represent the total increase or decrease in the cash balance for the period.”

Commenting on the results, chief executive Robert Thomson said: The second quarter highlighted the progress made in certain of our business segments. Obviously, a surge in interest rates and acute inflation had a tangible impact on all of our businesses. But we believe these challenges are more ephemeral than eternal.

“Just as our company passed the stress-test of the pandemic with record profits, the initiatives now underway, including an expected 5 percent headcount reduction, or around 1,250 positions this calendar year, will create a robust platform for future growth.”

News Corp trades at A$30.04 on the ASX as of 10 February, the market cap sits at US$11.89 billion (A$17.14 billion).

Linkedin

Linkedin

Have your say